World Cup: A game changer for tourism in Qatar?

Winning the bid to host the 2022 World Cup has propelled the tiny Gulf state of Qatar into the global tourism spotlight — but now the real challenge begins.

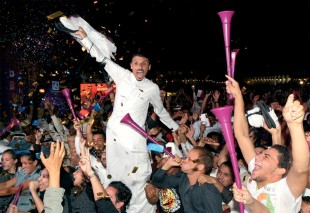

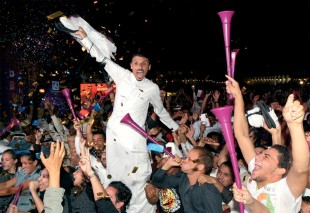

Jubilation greeted the news that Qatar will be hosting the world’s largest sporting event in 2022 — the first Arab country in history ever to do so. The achievement is an incredible one for a nation whose football team has never even qualified to play in the World Cup, added to the fact that Qatar beat off competition from the US by 14 votes to eight.

Some of the biggest cheers came from Qatar’s tourism and hospitality sector which is hoping that the World Cup, watched by millions around the world will be the key to propelling Qatar into the international tourism spotlight, as well as establishing the tiny Gulf state as a sports tourism destination on an international level.

Mohammed Al Ansari, head of Licensing & Classification Tourism Activities, Qatar Tourism Authority (QTA) said Qatar is already seeing a new surge in interest from prospective tourists, since FIFA made the shock announcement in December.

“The Qatar 2022 announcement is not just a wonderful opportunity for the country, but also a bonus for the tourism industry. Already we are seeing new interest in Qatar as a destination,” he confirmed.

Tourism is a major plank in Qatar’s strategy to diversify its economy — the country receives roughly 1 million visitors a year and expects growth of 20% in tourism over the next five years.

Currently 90% of visitors come to Qatar for business reasons alone, but the QTA is hoping the World Cup will entice a whole new segment of visitors to the destination: “With the 2022 announcement, and the events and opportunities ahead of this, we expect to see a significant rise in visitors here for tourism, culture and sporting events,” said Al Ansari.

Abdul Aziz Al Emadi, CEO of Qatari hospitality company Dohaland Hospitality believes the World Cup win puts Qatar in the running to promote itself as a “new tourism destination in general and very much a sports tourism destination specifically.”

“I can see the future impact of the World Cup will be very positive on the tourism industry,” he said. “In the long run, the country will have all the capabilities and requisite infrastructure to host other big international sport events and attract tourists and visitors on regular basis.”

Al Emadi has been involved with major sporting events in Qatar in the past, as accommodation advisor to the Doha Asian Games in 2006, but said: “the World Cup is on a totally a different scale — here, Qatar will have the greatest opportunity and potential to be distinguished as an international tourist destination in the coming years, until the World Cup and beyond.”

What's the game plan?

In order to cope with the huge influx of fans predicted to descend on Doha. Qatar will undergo a massive spending spree to bring tourism infrastructure up to scratch. Luckily, for the world’s biggest exporter of liquefied natural gas, money is no object.

According to FIFA’s Bid Evaluation Report on Qatar’s victorious tender, US$17billion will be ploughed into hotel development over the next five years.

The number of hotel properties will increase from the current 100 to 240 in order to meet accommodation needs, and hotel room inventory will more than double to 90,000. Two thirds of the new supply, which will amount to around an extra 55,000 rooms, will be covered by 17 construction projects, 13 of which will be completed by 2016.

This mind-boggling development raises concerns as to what will happen after the World Cup is over. Qatar already suffers from an oversupply problem. Data from the QTA showed that occupancy in the first half of 2010 averaged at 61%.

Jalil Mekouar, regional director and head of real estate advisory at Jones Lang LaSalle Hotels said: “Qatar will face similar issues as other countries have been facing, in terms of what do you do with all the inventory once the event is over.

This challenge will be amplified for Qatar as we are talking about a city state pretty much, and we talking of a small place physically.”

Guy Wilkinson, general manager at hospitality consultancy Viability agreed that oversupply was an issue, but said growth in tourism could sustain the sector: “The World Cup announcement has come at a crucial time in the growth of the hotel sector in Doha, which many privately feared was heading for oversupply and a rate war, as is being experienced now in Dubai’s Al Barsha district, for example.”

“Qatar has already witnessed the importance of a major global sporting event to its hotel sector, when it hosted the 15th Asian Games in 2006.

Not only were the hotels booked out during the two weeks of the games themselves, but they received significant and increasing demand for at least two or three years before that.”

One short-term solution to the accommodation problem is cruise ships. Cruise ships were used in South Africa during the last World Cup, when ships anchored off Port Elizabeth, Durban and Cape Town helped supply up to 4,500 extra temporary rooms.

According to the FIFA report, Qatar is planning a cruise ship project at the New Doha Port in Al Wakrah with 6,000 rooms.

Other challenges

Accommodation problems are not the only challenges on the horizon. There’s also the small issue of the soaring summer heat. Qatar may have promised to build some incredibly high-tech, climate controlled, zero-carbon emitting stadiums to protect the players from frazzling in the sun, but what about the tourists? The ferocious July heat is bound to put some visitors off.

And then there’s the issue of culture. While Qatar is eager to display a liberal and welcoming image, there’s no denying that the Islamic nation has a much more conservative culture than previous World Cup hosts. The sale of alcohol and the rowdy behaviour of tourists from around the world will no doubt present significant challenges.

Al Emadi admits that it’s essential Qatar works out all these issues in the 12 years leading up to event so that the country can fully capitalise on the benefits of the World Cup for the tourism sector in the years to come; “The Qatar 2022 bid is not just about the stadiums and the event itself, it is also about the people who will come and how their experience is going to be,” he said.

“People will spend most of their time outside football stadiums and around the city, and that is something the bidding committee was keen to address. We are working on creating a complete and unique experience so those who come go back with plans to visit Qatar. We have to carefully consider projects we put in place and the fact that there will be life after the World Cup.”

It’s a tough game: do countries benefit from hosting major sporting events?

Sports tourism is one of the fastest-growing sectors of the tourism industry — predicted to grow annually by six% over the next five years. But it’s also one of the most controversial.

At a seminar held recently at World Travel Market, experts debated the pros and cons of sports tourism, and how while the “impression prevails that those who successfully bid for a major sporting event automatically hit the golden jackpot” there is also a “misplaced view about how to make considerable, high-yield profit with relative ease.”

Tom Jenkins, executive director, European Tour Operators Association (ETOA) said that major sporting events can actually do more damage to a destination than good. Jenkins described the Olympic Games as “comparatively toxic in tourism terms.”

“Hosting the Olympic Games throws down problems for the inbound tourism sector,” he said. “One of the problems is the complete inability of cities to predict accurately how many tourists the event will attract. Sydney thought it would receive 132,000 people, but in reality they got 18,000 a day. Athens thought it would receive 105,000 a day, but they got about 9,500. Beijing thought it would receive close to 400,000 but it received 18,500 per day.”

According to Jenkins, hotel occupancy is traditionally shown to slump in cities either side of hosting a major sporting event. “In 2008, Beijing saw a 50% slump in occupancy before and after the Olympic Games.” “We have done research among our members which shows that two thirds of tour operators expect a similar decline in Britain in 2012 [during and after London 2012].”

Chris Foy, head of 2012 Games Unit, VisitBritain said the UK tourism board was working hard to mitigate against the “legendary stayaway factor” during the London Olympics 2012.

For last year’s World Cup hosts South Africa, the impact of the event on the tourism sector was a positive one, said Roshene Singh, chief marketing officer, South Africa Tourism. South Africa witnessed a 12.8% increase in visitor numbers during the event.

Singh admitted that the destination experienced some “displacement”, in terms of traditional tourists avoiding South Africa during the World Cup, but added: “I think this is now being corrected and more people are coming to South Africa. We saw with the World Cup how our brand positivity has increased, making the country a much more attractive place to visit.”