Supplier Survey 2011

Yes, it has been a year, where do they go? For suppliers to the region’s hospitality industry, 2010 might have been a year they were glad to see the back of as quickly as possible, but as our survey reveals, it certainly beat 2009.

It probably wasn’t a vintage year for everyone, although we would like to think the supplier who turned over a net profit of US $10-25 million would disagree, but most seem more optimistic and that can only be a good thing.

But as you read on, some of the same issues rear their ugly heads — late payments, broken promises and back breaking undercutting to secure business.

First let’s take a look at those who took the survey, which was completed by 56 respondents in total. More than half of our respondents (64.3%) sold something to do with F&B, whether it was food, kitchen equipment or kit for the restaurant or ballroom.

Both spa and in-room tech equipment were sold by 5.4% of our respondents, while furniture was supplied by 14.3%. At least 32 companies called the UAE their home, with Western Europe and Saudi Arabia making up 5.4% each.

The majority of those from the UAE were based in Dubai, although Sharjah made a decent showing. We would also like to say hello to our supplier from Buenos Aires.

The UAE was the place most of the firms conducted business (83.9%) but the rest of the region was well represented by the suppliers.

More than 71% were in Qatar and 69.6% of respondents sold in Saudi Arabia. Yemen and Iran were least represented with only 19.6% and 21.4% respectively of companies operating in those states.

For 66% of suppliers who took part, more than half of their business was tied up in hotels. For 8.9% of the companies, 100% of their business was supplying hotels.

Performance

Good news everyone! There was more than a 10% drop in the number of suppliers who only broke even or made a loss compared to the 2009 figure (from 34.4% in 2009 to 24.1% in 2010).

Added to this was a rise in those recording an increase in net profit in 2010 compared to the previous year.

Annual turnover also increased and it would appear that the growth in those making a profit has done wonders for confidence.

In our 2010 survey, 77.4% of respondents believed they would exceed their turnover in 2009.

This year’s survey reveals 84.4% of suppliers feel that there will be more turnover in 2011 than 2010; let’s hope the majority is right again.

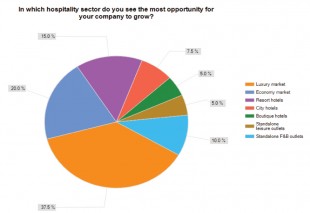

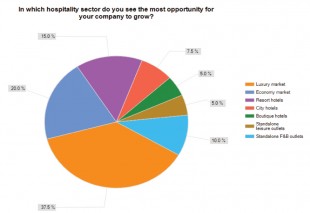

But where is the extra business going to come from? Nobody seems to have changed their mind since the survey in 2009 with Qatar and Abu Dhabi (both with more than 33% of the vote), running out as clear favourites as to where the next hotel boom would be taking place.

Supplier Sentiment

It would appear that while suppliers are feeling slightly more optimistic about the financial situation, there are a number of worrying sentiments for the hotel industry.

For instance, 82.5% of respondents “agree” or “strongly agree (42.5% of that figure)” that hotels are “scrimping on quality” because of reduced budgets. This marks an increase in the same sentiment in 2009 when 75% of suppliers believed it to be the case.

Added to this, 90% of suppliers believe that it is taking longer than ever to actually get paid by the hotels for work completed.

But the problems don’t end with the hotels — suppliers don’t seem to be doing each other any favours either, with 95% saying they believe companies are undercutting to secure business.

This was born out when we asked what suppliers felt was the biggest challenge facing their company in the year ahead.

The most popular response was “increased competition” (30%), with material costs and outstanding debts owed in second and third place respectively. It would also appear that the dramatic slowdown in hotel construction since the downturn is still a cause for concern for 15% of the companies in 2011.

Despite this, those who believed that hotels in the Middle East were improving their services were the majority over those who thought the opposite, a reverse of the beliefs expressed in last year’s survey.

Unfortunately, 2010 wasn’t a good year in terms of staffing either, with nearly half (47.5%) of companies making redundancies.

Added to this was 12.5% of companies who enforced a recruitment freeze to combat the downturn. But the good news is the worse might be over with a whopping 90% of suppliers saying they would be hiring in 2011.

Money, Money, Money

Such a robust sentiment towards increasing employment would surely suggest suppliers feel the financial side of business in the region is on the up? One figure that has dropped for the good of the supplier is the amount of companies owed more than $100,000.

In 2009, 35.2% of companies were owed more than this, but the percentage dropped to 17.1% in 2010 — a good sign that hospitality companies were prepared to open their wallets a little wider last year.

Furthermore, not one supplier said they felt they “definitely did not expect to receive payment” in this year’s survey, a sentiment 6.1% believed in 2010.

It would also appear that less suppliers fear having to close in a scenario where they don’t receive payment of the outstanding debt. Those who said non-payment would likely force the closure of their company dropped from 13.9% in 2010 to 6.7% in 2011.

Likes and Dislikes

Running a business is tough and recent economic and political turmoil hasn’t made it any easier. So why do our suppliers keep getting out of bed in the morning?

When asked what they most enjoyed about their job, the suppliers gave a range of answers, but perhaps the most apt to the current situation in the region was “there’s never a dull moment”.

Other enjoyments included; “the people”, “the competition”, and “the variation”, “creativity” was mentioned by more than one supplier, while another loved “seeing the results of the work done”.

Although one enthusiastic supplier replied “I love it!” when asked what they liked least about the job, and a couple said “nothing”, there were those who didn’t spend the whole year grinning from ear to ear.

“Long hours”, “dishonesty”, “workloads”, “chasing payments” and “unprofessional competitors” were common gripes. One supplier simply didn’t like “people”. Let’s hope 2011 cheers them up.