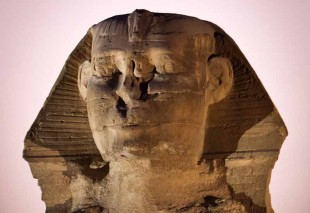

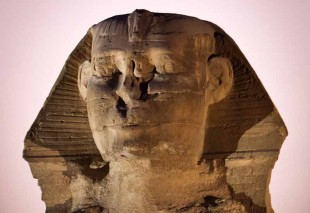

Egypt occupancy increases 39.7% YOY

The Middle East/ Africa region reported year-over-year growth in two of three performance metrics, according to STR Global’s February 2015 results.

North Africa posted the top increases in all three performance metrics when reported in US dollars.

The sub-region experienced a 3.7% improvement in occupancy to 47%, a 13.8% increase in RevPAR to $40.71 and a 9.7% rise in ADR to $86.39.

Egypt experienced significant increases in RevPAR (+33.3% to $36.75) and ADR (+28.9% to $78.00).

Elizabeth Winkle, STR Global’s managing director commented: “Egypt’s occupancy managed to increase for the eighth consecutive month”, Winkle said.

“The ADR growth also has been positive, continuing the strong ADR growth since 2013. Cairo managed to increase RevPAR by an astonishing 43.9 percent; however, this is still one of the lowest values in comparison to other sub-markets in the region”.

When looking at markets within the region, Cairo, Egypt, reported the highest increases in both occupancy (+39.7% to 51.2%) and RevPAR (+43.9% to $52.88).

In addition to Cairo, Beirut reported an occupancy increase of more than 20% (+24.7% increase to 49.3%). Beirut, like Cairo, also reported RevPAR increases of more than 25%: Beirut (+29.7% to $73.28).

The Middle East sub-region saw decreases in two of the three major metrics, including a 1.3% decline in RevPAR to US$159.61.

Abu Dhabi reported RevPAR increases of 29.2% to $151.15 and the emirate had the highest increase in ADR (+27.4% to $187.63). Doha followed with a 10.8% increase in ADR to $202.47.

Two Middle East markets that had double-digit RevPAR decreases were Amman (-19.2% to $79.61); and Muscat (-10.2% to $191.01).

While occupancy decreased in the Middle East/ Africa region as a whole, by 0.2% to 67.2%, average daily rate (ADR) increased 1.5% to US$176.64. Revenue per available room (RevPAR), increased 1.3% to $118.64.’

The moderate increase in RevPAR was driven primarily by ADR, according to Winkle, who commented: “Despite the Middle East showing a decrease in RevPAR, the sub-region still has the strongest figures coming out of the region.

“The Middle East recorded an ADR in excess of US$200.00 (US$214.56), including occupancy levels above 70% (74.4%). Whilst Northern Africa is posting strong improvement, occupancy remains below 50% in that sub-region”.

Nigeria reported decreases in all three performance metrics, including a 36.3% decline in RevPAR to $100.59. The sub-market of Lagos reported the largest occupancy decrease, falling 21.2% to 50%. It also had a double-digit RevPAR decrease of 29.8% to $111.15.

“Due to insecurity crisis issues in the region, Nigeria experienced a 22.9% decline in occupancy to 45.4% but is still maintaining high ADR levels exceeding $220.00 ($221.62),” said Winkle.

STR Global provides a single source of global hotel data covering daily and monthly performance data, segmentation data, forecasts, annual profitability, pipeline and census information.