Special Report: GM Survey 2016

General managers in the Middle East have many opportunities to look forward to, and a lot of challenges as well. In October 2016, planning for the 2017 Arabian Hotel Investment Conference (AHIC) started with the annual meeting of the AHIC Advisory Board. In a poll during the advisory meeting, members described business this year as “challenging” and “difficult” with their outlook for 2017 continuing to be “challenging”.

This sentiment was amplified by the latest figures from STR Global, presented by Philip Wooller, which showed a decline in a number of key performance indicators for the industry, including a 9.6% decrease in RevPAR across the Middle East, year to date.

Demand, however, continues to be positive with a growth of 2%, but with new supply up by 4.7%, further pressure on occupancies and room rates is likely in the short- to medium-term. The Middle East is still the fastest-growing region for new hotel rooms as a percentage of existing supply worldwide. In addition, Dubai was the second market globally in terms of GOPPAR in 2015, just behind Tokyo.

What does this mean for the region’s general managers, grappling with issues around new source markets, increased competition, and recruitment concerns?

WHAT’S AFFECTING PERFORMANCE?

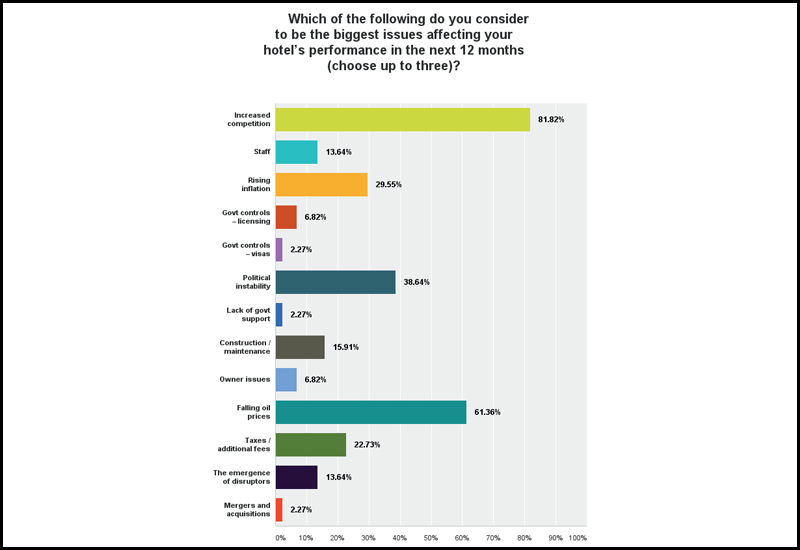

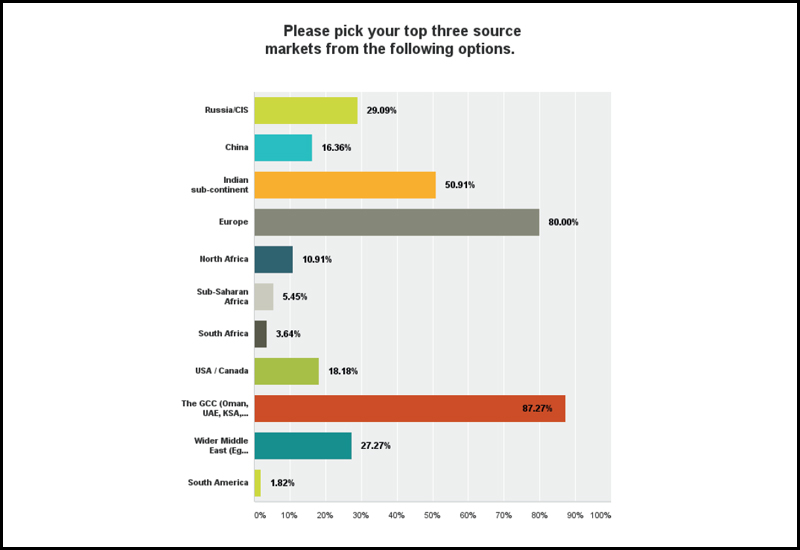

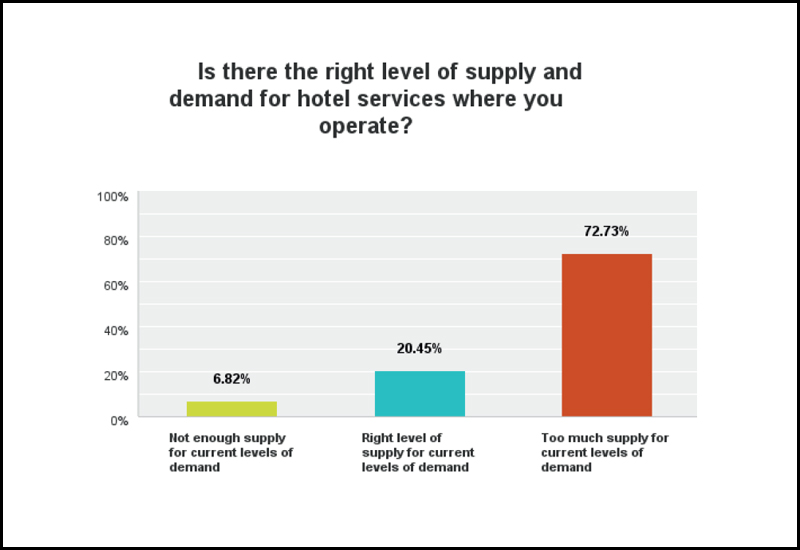

When asked which developments GMs consider to be their biggest issues affecting performance in the next 12 months, 81.82% said increased competition, and 61.36% said falling oil prices, with 80% saying occupancy and revenue was negatively impacted by the oil price drop. However, 11.4% said there was no impact on occupancy and revenue from oil price changes. Nearly 73% of the surveyed GMs said there is too much supply for the current demand.

The Radisson Blu Dubai Media City general manager David Allan told Hotelier: “I very much agree with the sentiment. To tackle these issues we simply keep doing what we’re doing: offering personality-led service and always something a little different.”

Mövenpick Hotel Al Khobar GM Peter Hoesli expanded further: “In my opinion, one issue has led to the other. The falling oil prices have affected many businesses in our destination and led to an increased competition amongst five-star hotels. Whilst only one five-star hotel has recently opened here in Al Khobar, the newer four-star hotels are definitely challenging the business of the established five-star properties.

“As most corporate companies here in KSA’s eastern province are related to oil and gas, their business has clearly lowered due to the falling oil prices and subsequently, companies are reducing the cost of travel and accommodation, amongst others. These all have led to a reduction in the ‘transient business contracted’ segment, but on the other hand, increased the non-contracted segment. Hence, the transient business no-contracted segment has drastically performed better than previous years.”

In the survey, one GM shared anonymously that “room rates have to be dropped to match the market”, while another said that occupancy was not affected, rather, it was rates and revenue.

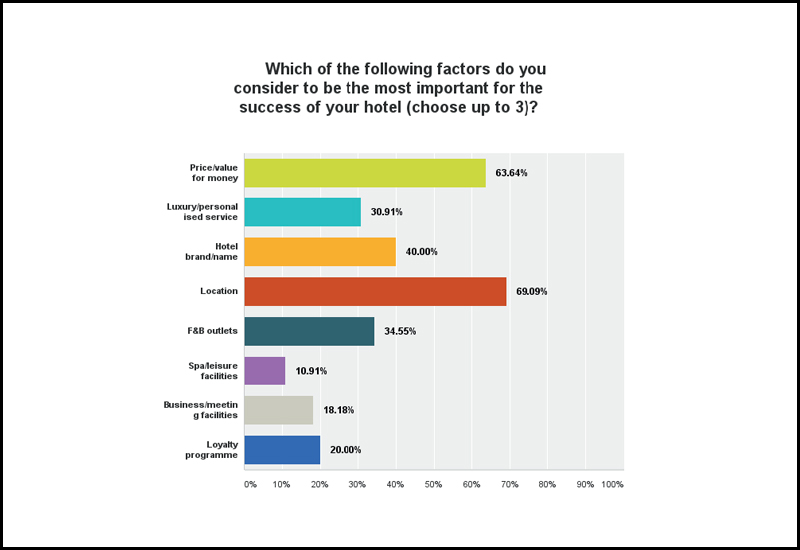

When it came to what the general managers thought were the most important factors contributing to the success of their hotel, 69.09% said location, 63.64% said price and value for money, while 40% said it was the hotel/brand name. This has stayed similar to last year’s viewpoint, showing that general managers believe the age-old chant of ‘location, location, location’ plays an important role in getting guests to book with the property.

DIRECT BOOKINGS

Considering bookings, Hoesli continued with the trends of the times: “We have noticed a good increase in the local leisure segment. Whilst in the previous years the hotels developed relationships with executives in charge of hotel bookings at corporate companies, we now are courting a much broader number of decision-making customers, who are booking within the non-contracted segments, mostly online through the hotel’s website or online travel agents (OTAs). This has heightened online competition amongst hotels in the destination.”

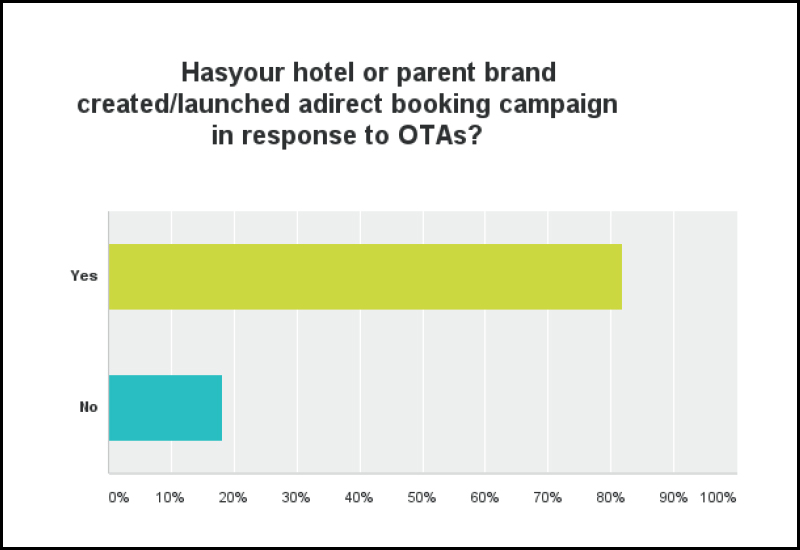

And this is a consistent trend. More than 80% of our participants said their hotel or parent company has created a direct booking campaign in response to OTAs.

Makkah Hilton & Towers general manager Ibrahim Alfati said: “It is our commitment to our valued customers that we offer best deals and top value at minimal efforts when customers decide to book direct through our various booking channels. Statistics show that over 60% of customers mistakenly believe that they can get best deals from OTAs, while 5% only of customers are aware of benefits of ‘Book Direct’ and we are working of changing this belief.”

Hoesli added: “These trends, as witnessed in 2016, are not expected to change in the coming 12 months. Also, I very much doubt that the ‘old’ way of doing business will ever come back. Therefore, social media, online reputation management and online booking channels have become even more important than before and are correspondingly emphasised by us.”

LOCALISATION

One of the topics that many people are talking about in general is the importance of nationalisation in hospitality recruitment, especially from the point of view of long-term sustainability. However, 9% of the respondents said it was easy to recruit local nationals as staff members in hotels.

Hoesli went against the vote, and said: “I believe that it is easy to recruit local nationals here in Saudi Arabia, mainly for administrative positions. Our aim is not to offer them a job, but a long-standing career within the hospitality industry. For this we have implemented the ‘KSA Professional Hotelier Programme’, which is a company initiative. Through this programme we have certified 32 Saudi nationals so far in 2016. We are now conducting additional courses, such as the Lessons in Leadership Programme, which spans several months. This will also assist our Saudi workforce, male and female, to discover the advantages of a career in the operational departments of a hotel.

“We are cooperating with several government-sponsored institutions, in order to provide opportunities to their students, emphasising also on the development of female students. Of course, as everything, it will need time to see the seeds grow and develop. However, the feedback from the participants is very good, and I can clearly see some successes in the making.”

Hoesli says that with increasing exposure and local nationals becoming more and more involved and successful in the hospitality industry, the industry itself will soon be seen as a viable career choice.

JA Resorts & Hotels, for example, provides opportunities for its UAE national associates to join and participate in professional hospitality industry associations such as The Union Internationale des Concierges ďHôtels, Les Clefs d’ Or UAE, AICR Côte ďAzur UAE, The Emirates Culinary Guild, and so on.

The hospitality group is proactive in sending its UAE national associates on externally-run college and university courses and training programmes to further their development in the field. In addition, it recognises the importance that mentors can play in harnessing talent and runs a ‘Hotelier Role Models Mentoring Programme’ to source and equip selected line managers with the skills to be mentors to the UAE national associates.

Torsten Obermann, area general manager of JA Ocean View Hotel and The Walk, said: “JA Resorts & Hotels has proudly supported the recruitment, development and career progression of both UAE and GCC national associates in the hospitality industry for over 14 years. We take great pride in nurturing and growing our local talent through our strong Emiratisation programme and have implemented a fast track recruitment process to source, select and recruit outstanding candidates. We are particularly delighted to see the strong work ethic and drive amongst our employees on our workforce.”

Waldorf Astoria Jeddah Qasr al Sharq & Hilton Jeddah GM Kevin Brett said: “Previously, we were finding it difficult to lure Saudis to join us for certain jobs in the hospitality sector such as stewarding, housekeeping, room service et cetera. However lately we have observed that there is a growing interest for them to be part of the hotel industry at different levels.”

He said that his properties offer one among the best salary scales among hotels in the region. “We also provide comprehensive medical insurance services for the Saudis and their direct family members, in addition to two days off per week. One of our main objectives is to provide local talent with competitive career opportunities in the different hotel trades that is balanced in terms of career development and working conditions in an environment that stimulates creativity and productivity.”

He highlighted the management development programmes designed specifically for Saudi youth, and specific regional programmes for local talents i.e. Mudir Al Mustaqbal Programme and the Engineering Graduate Programme which are currently implemented.

“Finally, we encourage all hotels to work closely with the hospitality schools/institutes to train and develop more young GCC nationals to join the hospitality industry which is a now major contributor to the GDP of these countries,” Brett added.

James Hewitson, general manager at Al Baleed Resort Salalah by Anantara in Oman, told Hotelier that Omani nationals make up 25% of the property’s total number of employees.

He said: “This falls in line with Anantara’s ongoing commitment to the local community in each of its destinations and our resort goal is to provide long-term and development opportunities for the residents of Dhofar. We are also working closely with the Ministry of Manpower as well as the Omani tourism colleges to recruit citizens as part of our Omanisation efforts to increase the awareness of the hospitality sector in the local community.” The aim of the property, Hewitson revealed, is to be the market leader in Omanisation within Salalah and grow its percentage year-on-year, with training an important factor in the operator’s attractiveness to local talent.

“A minimum wage has also been introduced for all Omani team members of OMR 400 (US $1,040) in an effort to ensure that the resort is paying competitively with other industries to attract the best young talent available,” Hewitson added.

It is worth mentioning on this note that 25% of the surveyed general managers said they believed that pay rates at their hotel are sufficient to retain talented staff.

LOOKING AHEAD

So what’s coming up? According to the survey, 72.73% GMs think there is too much supply for current levels of demand, while 6.82% think the supply isn’t enough, and 20.45% believe the supply is just right.

The biggest challenge in the coming year is “increase of rooms availability in the local market”, which is driving rates down. One GM said his/her biggest challenge is “staying competitive as rates keep on falling”. Quite a few general managers touched on the rates, with one saying that “surviving the silly price war many hotels are creating” is definitely an obstacle. However, one general manager was positive and stated: “Increased supply may increase the footfall and Dubai becomes a destination.”

Some of the respondents said they wished the local government could help “maintain supply and demand ratio” and “stagger the release of new inventory on to the market and not overload certain areas”. Others also called for governmental regulation on rates. One GM said: “The government has to inform the hotels [about] rates according to the star category, and how much they can go below. That means five-star hotels cannot go below certain rates, four stars cannot go below certain rates.” Another said pricing caps set by the government would be beneficial, and another said the local authorities should “put a ceiling on the lowest prices being charged by five- and four-star hotels to decrease the undercutting currently going on”.

Quite a few said the theme parks in Dubai would impact tourism positively. One said that “new attractions in the city [are] generating demand from fresh demographic sources”. On that positive note, 79.5% said that they are optimistic about the hospitality industry in the Middle East in the next five years.