Market update: Dubai is forging ahead

As Dubai inches closer to host the highly-anticipated World Expo 2020, hotel supply in the emirate is in full throttle. And, rightly so. Dubai expects to accommodate an estimated 25 million visitors who will funnel in between the Expo’s opening day on October 20, 2020 until its closing day on April 10, 2021. Approximately 70% of the visitors are expected to travel for the Expo from outside the UAE.

But Dubai has been witnessing an upswing in inbound tourist numbers for many years now. In 2017, the number of overnight international guests climbed to 15.8 million, a 6.2% year-on-year (YoY) increase from the previous year.

Olivier Harnisch, chief executive officer of Emaar Hospitality Group, says the steady rise in numbers is in line with the UAE’s lofty long-term vision, a five-decade government plan aptly titled, ‘UAE Centennial 2071’.

TRI Consulting associate director Christopher Hewett agrees. Hewett comments that Dubai, specifically, is “well on its way to reaching 20 million visitors by 2020”. There are also a significant number of rooms coming into Dubai over the next couple of years, Hewett adds, with predictions of about 40,000 rooms coming in from now until 2020.

However, Hewett worries that hotels in the pipeline lean disproportionately towards the upscale sector. “What’s disconcerting is that about 40% of that is going to be in the upscale sector. This will put pressure on existing five-star hotels on how to maintain market share and also how you’re going to try and combat the new supply, products and facilities. We think rates will continue to drop from this year and drop further in 2018 with the new supply that’s coming in,” Hewett notes.

2017 Performance

In 2017, the UAE witnessed approximately 6,000 branded hotel keys open and according to a report by Colliers International, Dubai took the lion’s share of that number — 78% to be precise. DTCM reported that by the end of 2017, a total of 107,431 keys were available across all hotel and hotel apartment establishments, representing a growth of 4% on the previous year. Within this, the most significant expansion of inventory came from the four-star segment, with a 10% increase to 25,289 rooms.

Some of the hotel openings included W Dubai – The Palm, Tryp by Wyndham Dubai, Radisson Blu Dubai Waterfront, Business Bay and Park Inn by Radisson Motor City Dubai, among others.

When benchmarked against other international cities, a 2017 report by Knight Frank highlights that Dubai leads the total number of room keys per person at 29.9 per 1,000 people.

While average occupied room night increased to 29.21 million in 2017 from 28 million recorded in 2016, according to the data released by DTCM, average daily rate (ADR) dipped to US$134 (AED 492) compared to US$139 (AED 511) reported in 2016. RevPAR also showed a slight dip to $104 (AED 383) in 2017 as opposed to $108 (AED 397) reported in 2016 across the board.

Glenn Nobbs, general manager of Copthorne Hotel Dubai, tells Hotelier Middle East that his hotel too showed a dip in RevPAR. 2017 turned out a bit tough for the property, compared to 2016.

“The demand for business was still there as we were only 1% short of matching 2016’s occupancy, however the ADR took a hit of about 6% in comparison, resulting in a drop in our RevPAR of about 8%. So while the rate was depressed (as witnessed across the city), overall we still managed to close with a gross operating profit (GOP) within 4% of 2016.

“So we had managed our expenses through the year particularly carefully to ensure maximum owner’s return, even with a greater drop in revenues,” Nobbs explains. However, Nobbs says the hotel, despite facing a challenging year, recorded a positive colleague engagement survey score of 86%.

Gloria Hotel Dubai’s general manager Freddy Farid also reports a dip within different months in 2017: “There was a drop in occupancy level and ADR. Dubai hotels and hotel apartments had a huge gap between RevPAR during summer and non-summer months in 2017.” And he attributed it to challenges most hoteliers in Dubai are facing — more supply but same or low demand.

Nobbs agrees stating that added supply brings forth new pressures to the existing labour market in hospitality. “New hotel openings mean potentially new career opportunities for existing colleagues which can also work for us positively in that we can transfer and promote our team within our hotel. However this adds pressure to the labour market and finding good, qualified candidates is proving more difficult,” Nobbs explains.

“The new supply also means sales teams now really earn their income, having to fight for each piece of business and work not just on discount but looking at what else will close the sale,” Nobbs adds.

And digitally, Nobbs points out OTAs are going through a “transformation period,” with both consolidation — for which Nobbs cites the recent merger of GTA and Hotelbeds in Q4 of 2017 — as well as direct connectivity, which he believes is changing the way hoteliers and hotel operators look at distribution.

Emaar on the other hand, which currently operates 11 hotels and three serviced residences in Dubai under three brands — Address Hotels + Resorts, Vida Hotels and Resorts and Rove Hotels — reported an uptick in occupancy compared to the emirate’s reported average for 2017.

“Emaar’s hospitality and leisure, commercial leasing and entertainment businesses recorded revenues of $741 m (AED2.722 billion) in 2017. Groupwide, we recorded an average occupancy of 79% in 2017, higher than Dubai’s industry average,” Harnisch reports.

Hospitality Management Holding (HMH) CEO Ferghal Purcell believes the increased hotel supply influences other factors. “Not only will the amount of new hotel supply continue to influence Dubai’s average daily rates, the type of new hotel supply entering the market will create a shift in the pricing landscape, with more offerings in the mid-scale segment,” Purcell notes.

Meanwhile, AccorHotels’ Fairmont Dubai general manager Ammar Hilal credits the property’s long-term presence on Sheikh Zayed Road for the past 16 years for the hotel’s consistent performance in 2017.

“Being an anchor on Sheikh Zayed Road for so many years, we have consequently witnessed a consistent, stable year, despite the increase in new hotel inventory. Occupancy levels have gone up throughout the whole city, led by the GCC, India, UK and German markets, as they are still delivering more than 40% of Dubai’s inbound traffic,” Hilal explains.

As for the hospitality landscape, Dubai remains an upscale to luxury positioned hotel market according to Colliers International. Approximately 50% of supply that entered the market in 2017 comprises five-star hotels.

Tourist traffic, source markets and segments

Annual traffic for 2017 reached 88.2 million passengers at Dubai International Airport (DXB), up 5.5% as compared to 83,654,250 passengers in 2016, according to the annual traffic report issued by Dubai Airports. DXB aided the traffic increase by introducing six new scheduled passenger airlines in 2017, including SalamAir, Badr Airlines and Air Moldova, while Dubai-based Emirates and Flydubai added three and 10 new passenger destinations and increased frequency as well as capacity on 31 and 22 routes, respectively.

Purcell points out that the aviation industry too will play a significant role in achieving the government’s tourism goals. “The growth of Dubai’s aviation industry is integral to the emirate’s long-term development strategy given that the city’s global connectivity is its foundation for growth. Dubai Airports has also revealed plans to boost capacity at DXB to 118 million passengers annually by 2023 under a new programme, dubbed as DXB Plus,” he explains.

In terms of country-specific source market performance, India retained the top spot in 2017, contributing 2.1 million visitors, and became the first country to cross the two million mark in a single year. The country’s performance represented a 15% YoY increase and validated, among other factors, the success of Dubai Tourism’s ongoing collaboration with Bollywood superstar Shah Rukh Khan’s #BeMyGuest campaign.

Impressive results from some of Dubai’s remaining top 10 source markets for inbound tourism included fifth-placed China with 764,000 tourists, up 41% while Russia took eighth place with 530,000 visitors, recording a commendable 121% increase over the previous year. Both markets benefited from easier access following the introduction of visa-on-arrival facilities to Chinese and Russian citizens in late 2016 and early 2017, respectively.

According to Harnisch, numbers from Emaar’s bookings reflected the same. “We have recorded increased guest arrivals from China and Russia, in line with the tourist trend, and we continue to have high occupancy levels of guests from Saudi Arabia, India and UK,” he says.

Nobbs says Copthorne Hotel Dubai, a dry hotel, attracts mostly tourists from the GCC. “GCC and mainly from Saudi Arabia and Kuwait due to the hotel’s popularity in the region being alcohol free and family-focused. We are also starting to see the hotel is proving popular with CIS and African markets due to its location and level of service, as we also explore those regions, which are quite new to the hotel,” he adds.

While Ayman Gharib, managing director at Raffles Dubai, a five-star luxury hotel, says the hotel is frequented by repeat luxury travellers. Gharib believes there is “higher value on privacy and wellbeing” for luxury travellers coming to Dubai. “At Raffles Dubai, we have a high number of repeat guests, close to 40% of our guests — which is a very high number in the industry and our trend is increasing year on year,” he adds.

Purcell says 50% of HMH’s visitors were free independent travellers (FIT) who seek a convenient stay, 35% were from the wholesale segment which include third parties who also offer fully inclusive packages, while 10% were reportedly corporate travellers. Purcell adds that 40% of HMH’s total bookings are derived from online travel agents (OTAs). For HMH’s hotels in Dubai, travellers from Saudi Arabia topped its bookings followed by Iranians and Indians tourists.

Gloria Hotel, which is a four-star serviced apartment in Dubai, saw Indian tourists top its books followed by visitors from Saudi Arabia, UK and China.

In terms of meetings, incentives, conferencing, exhibitions (MICE), Dubai World Trade Centre Authority (DWTC) reported that in 2017, visitors and delegates to the venue increased by 9% compared to 2016. The emirate’s largest trade venue hosted 353 MICE events which registered an 18% increase compared to its 2016 schedule. Visitors from 185 countries attended the events while 56,360 exhibitors from 154 countries exhibited last year.

Another segment that seems to be gaining ground in the emirate is medical tourism. In October of last year, Dubai authorities, Dubai Health Authority (DHA) and The General Directorate of Residency and Foreign Affairs Dubai (GDRFA-D) signed agreements to ease the visa procedures for incoming medical tourists. Hotelier Middle East, had reported earlier that the MoU was signed on the sidelines of the 37th edition of GITEX 2017. It is in line with the aim to help Dubai attract more than 500,000 medical tourists by 2020.

Wellness tourism has also experienced significant growth in numbers in Dubai, with annual spa revenue predicted to reach $495 million in 2019, according to data from The Spa & Wellness report produced by Colliers International. Dubai’s spa inventory is expected to grow from 107 in 2017 to 157 in 2021 which is in close correlation with the emirate’s hotel pipeline, the report adds. Recent spa openings include The Spa at Palazzo Versace Dubai and The Bulgari Spa, which will contribute to projected annual spa revenues by 2019, according to Visit Dubai.

Expo 2020 and beyond

Following a low-base mid-market and economy hotels, Colliers International says owners and developers are interested in building this segment and offer trendy lifestyle and innovative concepts that complement their luxury portfolio.

And according to Harnisch, Emaar already has properties in the pipeline to deliver to the growing demand in the segment: “There will be strong demand for midscale hotels and we have a development pipeline of multiple Rove Hotels in central locations across the city, four of which are already operational.”

At Gulf and Indian Ocean Hotel Investors’ Summit (GIOHIS) 2018 held late January in Abu Dhabi, it was revealed that Dubai, in the run up to World Expo 2020, currently has the largest hotel room pipeline of any city in the world, with more than 50% of planned rooms in the upscale sector.

But the big questions remains on hotel performance post the six-month period of the event which will be visited by millions of visitors. Harnisch claims that the heavy investment will bring long-term benefits.

“In fact, the preparations for Expo 2020 Dubai are not limited for the six-month period of the event; they are investments in our future and our outlook for the city’s hospitality sector is positive,” Harnisch points out.

On the other hand, Nemo Acimovic, general manager at Millennium Plaza Dubai, says he hopes the growing interest in the emirate will benefit post Expo 2020 too. “Although we are seeing signs of recovery on the market, the ever-growing supply over a demand, in the ramp up to 2020 Expo, continues to impact on desired expectations. However the interest for the region is continuing to grow and we are hoping to somewhat capitalise on that, with our favourable position on Sheikh Zayed Road and close to Emirates Towers metro station,” Acimovic explains.

With its strategic location, Acimovic believes Dubai is a “hub for all kinds of travellers” be it work, leisure, affinity or just a stop-over. “Moreover, Emirates and other carriers have expanded their network over new territories, so this would bring in additional travellers,” he adds.

Citymax Hotels COO Russel Sharpe, who spoke during the GIOHIS summit this year, said that after Expo 2020, hoteliers will have opportunities for development but have to be “creative” to drive the demand.

Sharpe believes there will be upcoming opportunities for midscale hotels and referred to Citymax, which he stated has been a success in the competitive three-star market since its launch in 2010. It entered with two Dubai properties at a time when there was a gap in the market for mid-range hotels, a statement said.

Adding to Sharpe’s comment, Hilal says Dubai, driven by the expanding supply, expects to see short-term rentals to gain momentum in the market. “Short-term rentals are expected to expand rapidly over the next five years. However, due to the relatively small difference in price compared to the hotel rooms, the short-term rentals will complement the overall lodging market growth rather than directly competing with hotels,” Hilal explains.

Purcell’s outlook towards post Expo 2020 is realistic. “There is no doubt that 2020 is a wonderful platform to further project Dubai as one of the most sought-after tourist destinations. We will need to however continually re-invent ourselves to remain innovative and exciting,” Purcell notes.

What to Expect

As Dubai keeps growing as a burgeoning tourism hub with the government aggressively pushing for a boost in tourism, Hewett points out hotels will notice a decline in revenue, “So while visitors will continue to pour into Dubai, the RevPAR might continue to see decline — about 6-7% — in the next 12 months,” Hewett adds.

The mid-market sector, as Sharpe and Purcell mentioned earlier, will grow, Hewett says, and while it’s about 10% of the new supply, it will drive demand. But Purcell contends that 2018 will remain a challenging year. He expects a marginal increase in the performance.

Harnisch predicts one of the key shifts will be the incoming millennial tourists who will influence many factors in the hospitality landscape. “One of the key shifts will be the increased number of millennial travellers — the new generation of entrepreneurs. The upcoming years will also see the evolution of new ‘feeder markets’ — especially from Asia and Africa, while the traditional source markets such as India, UK, Saudi Arabia, China and Russia will continue to gain traction,” he adds.

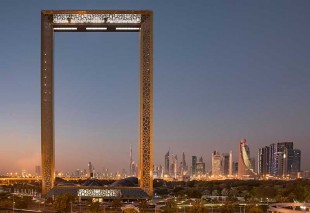

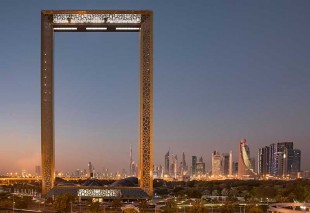

Dubai is also developing its leisure segment with the opening of key attractions such as Dubai Frame, the city’s newest impressive and imposing architectural landmark which opened earlier this year after New Year; La Mer, Dubai’s newest beach hotspot with numbers activities and F&B outlets and the emirate’s recently-launched desert conservation reserve, Al Marmoom Desert, which offers experiences such as dune cycling, star gazing and other experiential and cultural tours. Tourists are streaming into the emirate as it grows into a must-see glamour pit-stop in the GCC.

But just as in any industry, Dubai’s hospitality is taking a digital turn too when it comes to evolving towards a long-term sustainable model. Purcell says HMH is looking to artificial intelligence for a better user experience.

“We are maximising technological advancement and data leveraging through the usage of artificial intelligence to offer personalised recommendations and pricing. We also anticipate hotels with ‘smart rooms’ activated by mobile devices and properties with very modern interior design,” Purcell explains.

Hilal, however, claims that the future of the industry lies in tapping technical advancements with hospitality’s core motive — which is to please the customer.

“The future is all about how to measure emotions. We have a Minister of State for Happiness in the UAE, which showcases the government’s commitment to provide services that achieve customer happiness and I believe, hotels should also invest in designing intelligence platforms and advanced tools that allow to measure the guest’s experience and drive high satisfaction ratings,” Hilal affirms.

And this is true as Dubai plans to embrace sophisticated blockchain technology in an effort to boost tourism as the emirate diversifies the economy away from non-oil sectors. Blockchain technology is a virtual B2B marketplace with smart contracting, across multiple parties from the travel industry involved in fulfilling a travel itinerary, with transparent pricing, providing travellers with the ability to create more tailored journeys. The blockchain is part of the 10X initiative, first launched in February 2017, with the aim to make Dubai a world capital of innovation within the next decade.

Commenting on the advanced technology, DTCM director general Helal Saeed Almarri said: “At Dubai Tourism, we are determined to carve a reputation as global leaders in tourism innovation, exponentially accelerating our ‘digital, mobile and social’ first strategy. Today travel is undergoing one of the most emphatic sectoral transformations due to the radical pace of technological disruption across every aspect of the consumer journey.”