News analysis: A shift in owner-operator relationship in the Middle East

It’s been an interesting year for owner-operator relationships. Marriott International lost out to Hilton Worldwide after Al Habtoor Group replaced Marriott as the operator of its three Al Habtoor City hotels in Dubai and took over operations of the Al Habtoor Polo Resort. The three Al Habtoor City hotels are now franchised and operated by Al Habtoor itself.

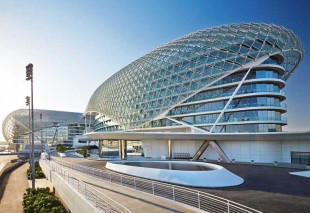

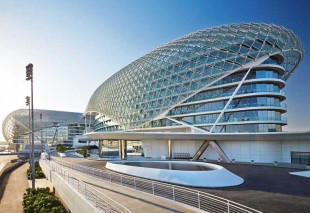

In Abu Dhabi, Viceroy was replaced as the operator of the Yas Island hotel by owner Aldar Properties. It will be refurbished and reflagged as Abu Dhabi’s first W hotel.

At the time the news was made public, Aldar Properties chief executive officer Talal Al Dhiyebi said in a statement: “Appointing Marriott International to manage the operations of our Yas Island hotel supports our strategy to employ the most reputable international operators and reflects our active approach to the management of our hospitality portfolio.”

Meliá Hotels International officially opened the Desert Palm Dubai Hotel under its Meliá brand, reflagging the property which was previously under the Per Aquum brand by Minor Hotels, on July 1.

Hotelier Middle East columnist and CEO of sps:affinity Martin Kubler noted that: “Around 2005 or 2006, owning a hotel in Dubai seemed easy. Business was good, brands were eager to come to the city, and returns were higher than on the residential leasing market. Everyone seemed to join the party and, for a while, things appeared to work fine.”

However, he says that things are now a bit different.

“There are still a lot of successful hotel owners out there, but you only need to look at recent headlines to realise that we’re witnessing the separation of the wheat from the chaff. Internationally flagged luxury hotels being suddenly taken over by their owners or flags being changed after just a few short years aren’t normal, but signs of a jittery market and, perhaps, desperate attempts to achieve higher returns,” he added.

Dubai hotel owners are opting for a new group of unbranded ‘white label’ operators to run their hotels, as opposed to international brands who take too much of the profit, and too little of the pain of slow market conditions, Simon Allison, the founder of hotel owner investor group Hoftel told sister title Arabian Business. He also said that owners then pay a franchise fee to the brand. And while the overall cost might be higher, owners’ general perceptions are that those operators are much more focused on their bottom line.

Echoing Kubler’s sentiments, Allison noted that hotel brands are not affected by factors that have an effect on the operating profit, such as the insurance, the property tax, the debt etc.

“You can actually have a situation where the hotel owner is losing money, but the brand managing the hotel is still making a healthy fee,” he said.

Which is why choosing the right operator is crucial. The plethora of hotel brands that sit under a singular umbrella group also means that owners should be more discerning when choosing their hotel operator, especially as it is increasingly difficult for standalone unbranded properties to make a meaningful impact on revenue per available room (RevPAR) in most destinations, according to Andrew Langston, executive vice president, strategic advisory & asset management of JLL’s hotels and hospitality division.

Langston advocates for owners to involve their chosen brand and operator from the beginning to avoid changes, modifications and an increase in construction costs to reach brand compliance, and a smoother pre-opening process, which can avoid a delayed opening.

According to Kubler, while returns aren’t what they used to be, owners can still successfully and profitably own hotels, if they pick the right operating partner. “You select a brand or operator that fits your property and its (potential) guests and you then work closely with the operator’s team on property,” he said.

Marriott International president and managing director Middle East & Africa Alex Kyriakidis told Hotelier Middle East in a recent interview that while the region is seeing tremendous growth, there are some markets that pose a challenge.

In particular, Kyriakidis pointed to the UAE hotel market which has over a 100,000 keys in operation and in the pipeline, which builds pressure on the supply.

“In any market you have cycles, in 2009 we had the global economic crunch, which impacted the industry on a global scale then sadly we have terrorism or natural disaster cycles like September 11 that pretty much hit the New York City hospitality market for two years. Then the third cycle is the oversupply cycle that puts pressure on the existing market,” he said.

The figures don’t lie either. While STR’s preliminary July data for Dubai indicated performance consistent with strong growth in both supply and demand, ADR levels are poised to fall to their lowest since August 2004.

STR said in a statement: “Although growth in demand (room nights sold) was significant, performance levels remained low due to pressure from increased supply. The absolute ADR level would be the lowest for any month in the market since August 2004.”

But Kyriakidis sees the market correct itself with the beginning of Expo 2020. According to him, the challenge right now is getting the owners on-board.

“The owners have to work closely with us to ride through it and it always bottoms out and it always comes back. So the challenge always is that we have to work closely with our owners to help preserve as much of the bottom line as possible until the upside returns,” he explained.

Radisson Hotel Group’s region vice president Tim Cordon, however, believes that owners and operators should just have a heart to heart.

“The decision making process needs to be nimble. You need to have decision makers at the local level that can immediately change and adapt to suit the owners’ needs,” Cordon said.

According to Cordon, in this market, when you see a correction of rates, the real important thing for operators is to have a clear plan.

“If operators have a clear plan in reaction to the market and you have a discussion with your owner with a result oriented focus that will help you forge a stronger relationship,” he believes.

However, he also stresses that a break in relationships happen when operators put their needs in front of the owners’ needs.

In our June issue, we noted how there seems to be a trend of owners either looking at changing operators — evidence being the number of reflaggings in the regional market right now — or operating the properties themselves. Operators seem to have to really showcase why exactly they should be signed on.

At Arabian Hotel Investment Conference earlier this year, Ròya International CEO Kees Hartzuiker also noted that visibility is an issue. He said: “On both sides there has to be more visibility on the actual investment and expectations. The operators seem to have very little connection to the level of investment being made and down the line it hurts.”