Oman: a sophisticated tourist destination

Lee Jamieson explores the emergence of Oman as a sophisticated tourist destination with strong brand values that set it apart in the Middle East

Oman is busy rebranding itself. Less than 25 years ago, it was a non-welcoming country with little interest in tourism. Today, Oman has proved itself to be a sophisticated tourist destination with strong visibility — and it is fast attracting the attention of big-name international hotel brands.

Last year the Oman Brand Management Unit launched a new “tourist friendly” national logo for the country, dropping the traditional Omani dagger. Brand Oman was officially born in January 2009 and prides itself on promoting “the essence of Arabia” by focusing on the county’s rich cultural heritage.

With resilience in the face of economic downturn, liberalisation of its foreign direct investment policies, and heavy investment into its tourism development, including a US $3 billion expansion of its airport infrastructure, Oman has never been so attractive to hotel developers, owners and operators.

A brand is born

With diminishing oil and gas resources, Oman has been diversifying its economy through the development of its tourism industry. This year marks the halfway point for His Majesty Sultan Qaboos’ Vision 2020, which outlines the strategic direction for Oman’s travel and tourism industry.

A key development in this plan was the creation of a new Ministry of Tourism in 2004. Alongside developing Oman as a high quality destination, the Ministry also deployed representatives into its European source markets with measurable success. For example, Euromonitor International reports that arrivals from the UK have experienced a compound annual growth rate of 45% since 2003.

“According to the World Travel and Tourism Council, Oman’s tourism sector is one of the fastest growing in the world,” says Rotana chief operating officer Imad Elias. “The growth rate is attributed to an increase in lodging capacity and efforts made to market the sultanate as a tourist destination, which presents lots of opportunities for a management company like Rotana.”

Oman’s strategic and financial commitment to its tourism industry has created an attractive business environment for hotel developers, owners and operators.

“There has been a definite increase in tourism in Oman over the last few years, which has had a positive impact on the hotel industry,” says InterContinental Hotels Group vice president for development Phil Kasselis. “This year the country is on course for an 11% increase in tourists, taking it past the two million mark as Gulf residents look for an alternative holiday destination in the region.

“Against the backdrop of the country’s strong economic performance, travel and tourism has now emerged as one of the main pillars of the Omani economy. This creates a strong foundation for investors and the financial institutions backing those investors.”

However, hoteliers should be mindful that Oman’s emergence as a tourist destination is not yet complete and could be prone to growing pains. “While Oman is an attractive leisure destination it is not yet equipped to deal with large scale tourism and events,” explains Mövenpick Hotels and Resorts senior vice president in the Middle East, Andreas Mattmuller.

“It is therefore important for developers and owners to ensure that their product fits the market.”

The Omani government has also adopted a cautious approach towards mass tourism and has focused its efforts on fostering growth within specific sectors and niches. Arguably, this has enabled distinct brand identities to emerge across the industry.

Luxury brands

Oman’s priority was to foster growth at the high end of the luxury rating, enabling it to reap the financial benefits of tourism while minimising its impact upon local resources. Its reputation for high-end hospitality experiences continues to attract luxury and boutique brands. For example, Rotana has recently secured the new management contract for the five-star Salalah Rotana Resort, a 400-room property opening in early 2012.

A Hotel Missoni, Rezidor’s latest boutique offering, is also planned for Oman. This designer brand has been developed in co-operation with the iconic Italian fashion house Missoni and will open as a 250-key property on a self-sufficient resort 30 kilometres from Muscat in 2012.

As you would expect in the current economic climate, work has slowed on many high-end developments.

Worst hit was the Blue City, Oman’s landmark tourism development project, which had its US $400 million bonds downgraded by Moody’s in Q4 of 2008. Despite its financial woes, the developer has confirmed that the first phase of the 34 square kilometre project is on schedule and will be delivered later this year. Phase one will deliver the first of its 16 hotels: a boutique property operated by Anantara.

Mid-market brands

Maturation on the higher end of Oman’s luxury rating has created a need for mid-market brands and international operators are looking to expand their portfolios appropriately. For example, last year saw Rezidor launch Park Inn, its flagship mid-market brand, for the first time in Oman.

“We recognised an opportunity for our Park Inn brand in Muscat because this market has been largely served by international brands aimed at the luxury traveller,” explains The Rezidor Hotel Group area vice president, Marko Hytönen. “Park Inn offers a fresh and innovative alternative to this by delivering a great, yet affordable hotel experience.”

The market need for mid-range concepts has also caught the eye of Premier Inn Hotels’ managing director Darroch Crawford, who has recently signed a joint venture agreement to develop Premier Inn properties in the country.

“I think that the country has a shortage of affordable hotels in several key locations and is therefore ideal for Premier Inn investment,” says Crawford. “Strategically speaking, we plan to establish Premier Inn as the leading brand in our sector of the market across the GCC, so Oman is a key target for us. We are currently working on our first property in Muscat followed by projects in at least two other areas.”

Eco-Brands

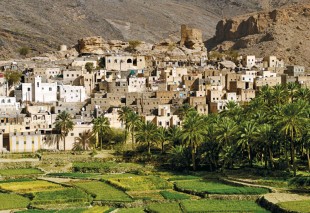

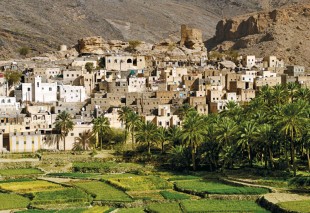

The slow-but-steady trend for responsible tourism in Oman has followed the Omani government’s policy of fostering a quality tourism experience — attracting visitors to its cultural heritage rather than promoting its beaches.

“Oman is becoming a popular eco-destination and is internationally known for its wildlife,” says IHG’s Kasselis. “There is bird watching, whale watching, diving and natural reserves for visitors to explore. It also has an unprecedented number of UNESCO-classified world heritage sites for its size.”

The Environment Society of Oman was established in the same year as Oman’s Ministry of Tourism and is tasked with preserving Oman’s environment — both natural and cultural. The result is a serious commitment to sustainable tourism development quite unlike any other country in the region.

“Oman is determined to promote itself as a high-quality destination aimed primarily at responsible tourists,” explains Mövenpick’s Mattmuller. “This is all part of Oman’s long-term vision, which is based on sustainability, cultural heritage, quality and security. These attributes offer great opportunities to investors in the long term.”

By fiercely protecting its Arabian culture and heritage, Oman has managed to foster a travel and tourism industry that rejects the cookie-cutter approach. Instead, Oman offers an authentic experience to visitors and hotels are encouraged to work alongside communities in a responsible manner.

This has informed the approach of Marriott, which is entering Oman in 2010 for the first time via Salalah with its 237-key property.

“This is a very authentic country and we do not want to turn up and impose ourselves upon the local community,” explains Marriott Hotels International area director for sales and marketing in the Middle East, Jeff Strachan.

“We prefer to grow into an integral member of the community, properly and responsibly. It is always wise to be understanding of the local customs and nuances and be sensitive to the opinions of the local community.”

Omanisation

According to Euromonitor International, Omani nationals currently account for 37% of the tourist industry’s workforce. By the end of this year, the government wants to increase this to 85%.

Having a high percentage of Omani nationals working in the industry will be successful on two fronts: not only will it create jobs for Omani locals, it will also strengthen the authenticity of Oman’s tourism experience and cultural heritage.

However, achieving the government’s Omanisation targets is forcing hoteliers, already coping with an international talent squeeze within the hospitality industry, to reconsider their recruitment strategies.

“The high Omanisation targets are challenging,” says Hytönen.

“This is particularly true for the private sector and our recruitment strategy in Oman differs to that in other Middle East countries. We are aggressively recruiting, training and promoting local staff within our hotels and we are very proud to confirm that we have managed to achieve a very high Omanisation percentage,” he continues.

“In fact, Radisson won an award for being the best employer for Omani nationals.”

For Omanisation to be successful in the long term, hoteliers need to work closely with local colleges to foster a strong Omani workforce capable of dealing with the demands of the hospitality industry.

They also need to develop and progress Omani nationals into middle management roles, where the talent squeeze is most acute.

This has become a primary concern for most of the major operators, including IHG, which claims that Al Bustan Palace InterContinental Muscat has the highest quota of Omani employees than any other hotel in the sultanate.

“Not only do we ensure that 85% of our staff are Omani nationals,” explains Kasselis, “but we also ensure that Omani nationals work across all hierarchical levels by putting in place succession plans to grow our Omani staff into managerial roles.

“At IHG, we have developed training and development programmes for our employees to help build and maintain a strong common culture, helping to minimise our attrition rate and entice great new employees from both the local and international communities.”

It seems that Oman is in control of its own destiny. Its rapid expansion is being strategically channelled by the government’s strong, long-term vision and adherence to a clear set of brand values.

Also, the Omani authorities are unafraid to put in place difficult policies to protect its greatest assets: its cultural heritage, natural beauty and its people. Having earned its much-deserved respect from hotel operators, Brand Oman is here to stay.

10 reasons to invest in Oman

1 Maturation of the market is providing fresh investment opportunities in most sectors.

2 Arrivals into Oman are set to more than double by 2013.

3 An effective network of market-based representatives provide good reach into Oman’s key source markets.

4 The expansion of Muscat International Airport is set to increase capacity to 24 million passengers (from three million passengers in 2007).

5 Three new airports are planned for Oman’s key tourist areas.

6 A clear tourism strategy has been put in place by Oman’s Ministry of Tourism.

7 Recent liberalisation of Oman’s fiscal policies has attracted higher levels of FDI.

8 Restrictions on foreigners owning freehold properties has been lifted in tourist areas.

9 Competitive operational costs for businesses.

10 Tourism concepts can easily be built around Oman’s naturally rich cultural heritage.