Performance

Good news everyone! There was more than a 10% drop in the number of suppliers who only broke even or made a loss compared to the 2009 figure (from 34.4% in 2009 to 24.1% in 2010).

Added to this was a rise in those recording an increase in net profit in 2010 compared to the previous year.

Annual turnover also increased and it would appear that the growth in those making a profit has done wonders for confidence.

| Advertisement |

In our 2010 survey, 77.4% of respondents believed they would exceed their turnover in 2009.

This year’s survey reveals 84.4% of suppliers feel that there will be more turnover in 2011 than 2010; let’s hope the majority is right again.

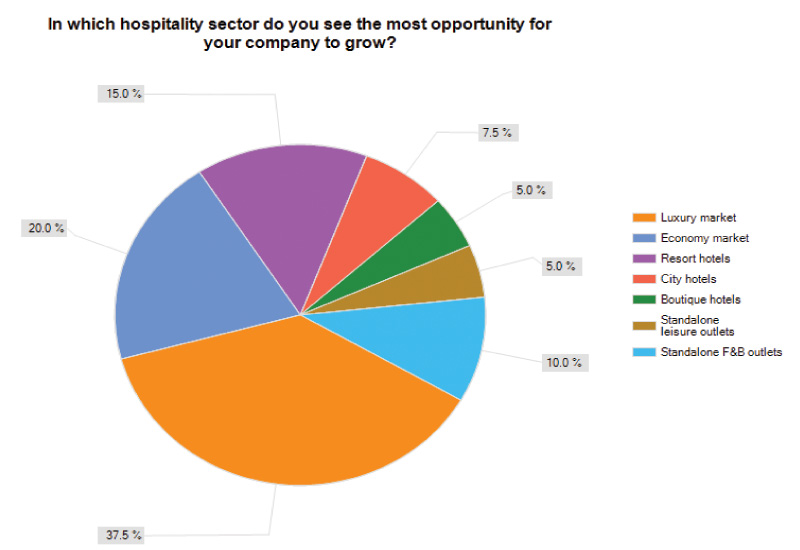

But where is the extra business going to come from? Nobody seems to have changed their mind since the survey in 2009 with Qatar and Abu Dhabi (both with more than 33% of the vote), running out as clear favourites as to where the next hotel boom would be taking place.

Supplier Sentiment

It would appear that while suppliers are feeling slightly more optimistic about the financial situation, there are a number of worrying sentiments for the hotel industry.

For instance, 82.5% of respondents “agree” or “strongly agree (42.5% of that figure)” that hotels are “scrimping on quality” because of reduced budgets. This marks an increase in the same sentiment in 2009 when 75% of suppliers believed it to be the case.

Added to this, 90% of suppliers believe that it is taking longer than ever to actually get paid by the hotels for work completed.

But the problems don’t end with the hotels — suppliers don’t seem to be doing each other any favours either, with 95% saying they believe companies are undercutting to secure business.

This was born out when we asked what suppliers felt was the biggest challenge facing their company in the year ahead.

The most popular response was “increased competition” (30%), with material costs and outstanding debts owed in second and third place respectively. It would also appear that the dramatic slowdown in hotel construction since the downturn is still a cause for concern for 15% of the companies in 2011.

Despite this, those who believed that hotels in the Middle East were improving their services were the majority over those who thought the opposite, a reverse of the beliefs expressed in last year’s survey.

Unfortunately, 2010 wasn’t a good year in terms of staffing either, with nearly half (47.5%) of companies making redundancies.

Added to this was 12.5% of companies who enforced a recruitment freeze to combat the downturn. But the good news is the worse might be over with a whopping 90% of suppliers saying they would be hiring in 2011.

Search our database of more than 2,700 industry companies

Search our database of more than 2,700 industry companies