INDUSTRY OPINIONS

The Hotelier Middle East Supplier Survey gauged suppliers’ views of hotel operations in the region — and found that the responses were far from positive.

The suppliers were asked to agree or disagree with a variety of statements on the state of the industry and 48 answered this question.

Of these, 75% said they “strongly agreed” or “agreed” that “reduced budgets mean hotels are scrimping on quality”. Only 2.1% “strongly disagreed” with this statement.

And less than half (45.8%) said they “strongly agreed” or “agreed” that “hotels in the Middle East are improving their services”.

Even more challenging, however, is that not only do the suppliers face issues when dealing with hotels, but 90% said they “strongly agreed” or “agreed” with the statement that “suppliers are undercutting each other to get the deals”.

Advertisement

MONEY MATTERS

Putting the pressure on the hotels even more, almost 80% of respondents “strongly agreed” or “agreed” that “it is taking longer than ever to receive payment from hotels for suppliers services”.

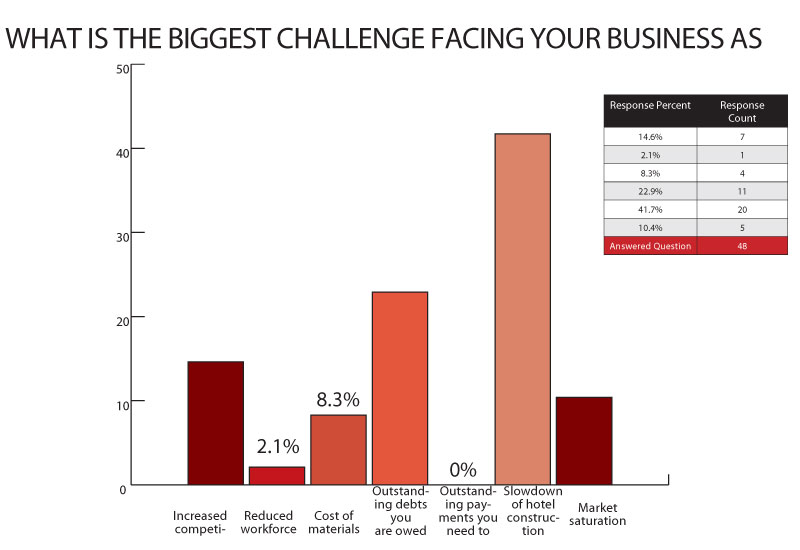

For 22.9% of respondents, outstanding debts owed to their company was the biggest challenge facing their business as a result of the economic downturn.

In total, 70.4% of respondents (out of a sample of 34) said they were owned money from hotel companies that have not yet paid for services rendered. The fees varied dramatically but for 8.8% of respondents, it exceeded US $1 million.

For 35.2% of companies, they were owed in excess of $100,000.

So, how confident are the suppliers of being paid this money?

Fortunately, the majority do expect to receive payment.

Three quarters (75.8%) said they believed they would “definitely” get the payment or that they were “very confident” of receiving payment.

Of the remainder, 15.2% said they thought they “might receive payment”, 3% said they were “not very confident of receiving payment”, and 6.1% said they “do not expect to receive payment”.

If they do not receive outstanding payments, 13.9% of 36 respondents said that they faced the risk of having to close their company.

STAFF SIZE

Despite the broad geographical stretch of the 66 supplier companies that responded to the survey, hotel suppliers tend to operate as small to medium-sized businesses, according to the sample.

Almost two thirds (62.1%) of the respondents said there were less than 50 people in their company, with one fifth (19.7%) of businesses having five members of staff or less.

Only six of the 66 respondents reported head counts of 1000-plus.

The survey found that hotel suppliers, just like some hotel operators, had to make redundancies in 2009.

In total, 41.7% of companies made some redundancies in 2009.

A further 12.5% reported a recruitment freeze and 45.8% said they did not have to make any redundancies.

Of the 48 suppliers that responded to the question ‘do you plan to recruit in 2010’ the results were positive, with 77.1% of companies saying they did intend to recruit.

Search our database of more than 2,700 industry companies

Search our database of more than 2,700 industry companies