Spas must develop treatment room usage and residential market visitation in order to boost business, according to inaugural PricewaterhouseCoopers Dead Sea Spa Benchmarking report

The first Spa Benchmark survey for Dead Sea spas in Jordan from PricewaterhouseCoopers (PwC) has revealed that treatment rooms are under utilised, according to PwC partner and Middle East leader — real estate, hospitality and construction Mohammad Dahmash.

The Dead Sea Spa Benchmarking Survey gathered data from leading spa resorts in Jordan’s Dead Sea and tracked 10 key metrics related to operational performance — one of which was revenue per available treatment hour (RevPATH), explained Dahmash.

“The metrics were selected as part of our objective to provide spa operators with a benchmark of internal spa operations that can be used as a tool for driving operational decisions and profitability, as well as information on common indicators that can be used by investors and developers in the sector,” said Dahmash.

RevPATH, in a similar way to hotel room revPAR, is calculated by dividing total spa treatment revenue by the total number of treatment room hours available.

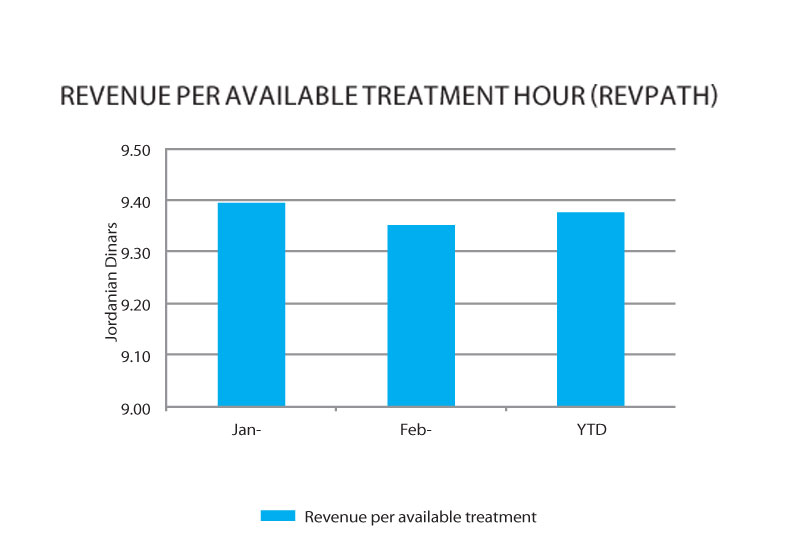

“The average treatment revenue per treatment sold for the first two months of 2010 was JOD 54 (US $76),” revealed Dahmash. “Revenue per available treatment hour (RevPATH) was JOD 9.4 (USD $13) on a year-to-date (YTD) calculation.

“This represents only 17% of the average treatment revenue per treatment sold over the same time frame, suggesting that the spas are under utilised,” he explained.

Advertisement

Dahmash revealed that treatment room hours were also under used.

“This is also reflected in the under utilisation of treatment room hours at a YTD average of 17% and therapists hours at approximately 33%. Both figures have remained constant over the first two months of the year,” he said. (see chart in images)

Weaknesses were also found when it came to spa memberships and spa retail, according to the benchmarking report.

“None of the hotels reported any income from fitness and membership revenue. This can be attributed to the lack of affluent local population in the immediate area surrounding the Dead Sea,” said Dahmash.

“Similarly, retail revenue at approximately 7% of total revenue remains as an under capitalised revenue stream.”

Another issue was capturing the local market, as the report demonstrated that the Dead Sea spas were heavily reliant on hotel guests.

“As of February 2010, in-house guests accounted for approximately 84% of total treatment hours sold with the remaining 16% contributed by walk in guests for the same period,” said Dahmash.

“This suggests that more could be done by the spa operators to improve visitation from the local population, particularly from Amman which is only a 45 minute drive from the Dead Sea area.”

The Dead Sea Spa Benchmarking Survey will be carried out bi-monthly and PwC has plans to expand its benchmarking reports to include Lebanon, Egypt and other GCC countries over the next six months. The company will also be starting a hotel benchmark for Libya in the near future.

Search our database of more than 2,700 industry companies

Search our database of more than 2,700 industry companies