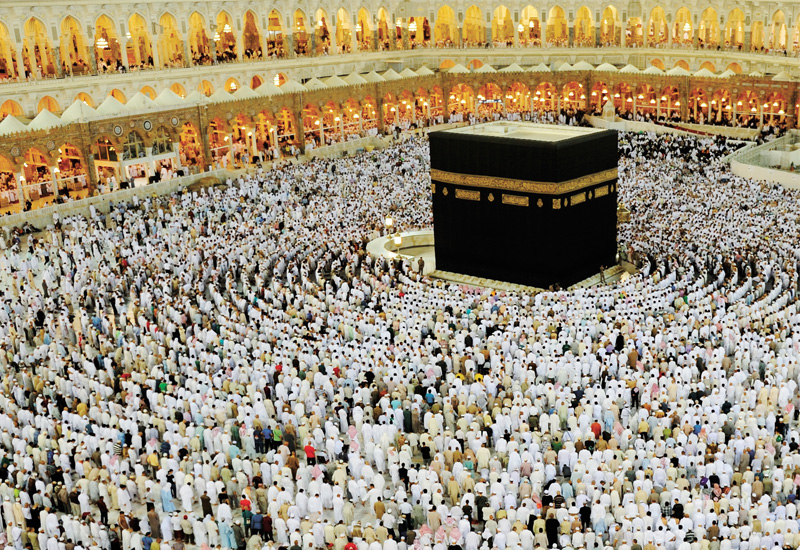

Kaaba Makkah Hajj Muslims. The demand for accommodation during religious seasons is fuelling hotel growth.

Kaaba Makkah Hajj Muslims. The demand for accommodation during religious seasons is fuelling hotel growth.

Ramping up in Riyadh

Speaking of Riyadh, overall the city has performed well in 2012 with RevPAR from January to September at a reasonable $149.34. It would have been better if it wasn’t for low average occupancies of 59.6% due to a rough summer partly attributed to the temporary relocation of government offices from Riyadh to Jeddah.

Average occupancy was as low as 29% in August 2012, compared to an average occupancy of 79.10% in Jeddah.

“In the summer months the majority of people go on vacations with their families and activity slows down, particularly in Riyadh. It has a seasonality aspect,” explains Hewett.

| Advertisement |

Christie+Co director John Podaras believes: “Riyadh doesn’t do great in the summer months because it’s a corporate destination. Riyadh’s also seen quite a ramp up in supply compared to three or four years ago with a number of projects coming online”.

Best Western Orchid Hotel opened in Riyadh most recently in August, alongside other new openings.

However, Podaras says there is still “a lot of room” in the midmarket and serviced apartment sectors in Riyadh, something the operators are looking to capitalise on.

Golden Tulip, part of Louvre Hotels Group, already operates 20 three- and four-star hotels in Saudi Arabia, five of which are in Riyadh.

Of the hotels in Riyadh, Golden Tulip operates three under its three-star Tulip Inn brand and two under its four-star Golden Tulip brand.

The firm has another four signed properties in the pipeline for Riyadh, comprising two four-star hotels and two three-star hotels.

While the operator also has plans to open a hotel under its five-star Royal Tulip brand in Riyadh, Golden Tulip MENA president Amine E. Moukarzel agrees that the majority of opportunities lie in the mid-market sector.

“I will develop one Royal Tulip in Riyadh, which is already under negotiation, but [we’re targeting] five Golden Tulip and five Tulip Inns,” he says, adding that in the time it takes to develop a luxury property, several mid-market hotels can be established.

Podaras adds that these mid-market properties are popping up across the kingdom “like mushrooms”. This suggests the number of properties coming up in this segment may be significantly greater than those forecast in the current pipeline.

“One example is the Hilton Garden Inn, a conversion, which popped up in only nine months,” says Podaras.

Only last month, Wyndham inked a deal to open 10 economy hotels in the Kingdom under its Days Inn brand. It did not state in which cities these hotels would open.

Article continues on next page ...

Search our database of more than 2,700 industry companies

Search our database of more than 2,700 industry companies