Confidence in the Middle East hotel employment market is falling, continuing last year’s trend when 23.8% of participants said they felt less secure than they did 12 months ago. This year, 38.8% expressed the same. The decline in Russian visitors, along with financial concerns and falling oil prices, have continued to make their presence known.

Sources have told Hotelier that the job market isn’t conducive to new opportunities at the moment, while others have reported pay freezes in their companies.

While the start of the year saw a definite uncertainty when it came to occupancy and ADRs, most hoteliers we spoke to at Arabian Travel Market said they saw better results from March onwards, with forward bookings giving them hope for the rest of the year. H Hospitality regional director and The H Dubai GM Kevork Deldelian told Hotelier: “In April we’re going to hit 87% occupancy, whereas last year we were at 84%.”

| Advertisement |

Speaking to Hotelier Middle East, Alila Hotels & Resorts regional vice president and Alila Jabal Akhdar acting general manager Julian Ayers said: “It [performance] has actually turned out very well. We had a rocky start; I think everybody did in January. February, March and April have turned out very well, and May is looking positive. Lead time is getting shorter so it’s getting harder to tell whether you’re going to have a good month or not, but it’s looking very positive again.”

Agreeing is Six Senses Zighy Bay resort manager Greg Kocsis, who said the outlook for the next few months is positive, adding that the only downside is that “the perception about the region is mixed because of the sad events over the last few months”.

This mixed perception might be why confidence is still down. Last year, 13.5% said they feel more secure than they did 12 months ago. In 2014, that was 20.7%. This year, it’s gone down to 11%. However, the number of hoteliers who are anxious about keeping their jobs has reduced ever so slightly to 10.3%, from 11.1% last year. It still has not gone back down to 2014’s low of 4.6% hoteliers who were anxious about their jobs.

Last year, 0.5% of our respondents were told they were being made redundant, and this year, 2.2% reported the same.

However, things may not be as bleak as they were a few years ago. Speaking to Hotelier during AHIC 2016, STR managing director Robin Rossmann said: “Where we are today in the Middle East is very similar to where we were back in 2008-2009. Both from a supply perspective, where we’ve got this big pipeline and potential growth that could result in a 50% increase in supply over the next three to five years. And a lot of concern — while we’re not in a global recession yet — performance is declining double digit, in a way that it was in 2008-2009.

“A lot of people are quite concerned because you’ve got RevPAR going down, revenue is going down. And the expectation of all this new supply, which is only going to make things more difficult for existing hotels.”

He continued: “We went back and did an analysis of what actually happened back in 2008-2009, and how that played out for six years. Despite what probably most people said at the time, the market managed to absorb all of that supply — but actually did more than absorb it. Demand grew bigger than supply, supply grew 40%, demand grew 50%. Yes, there was some decline in average room rate, but that wasn’t there until this year.”

Respondent Demographics

The Hotelier Middle East Salary Survey 2016 attracted 294 responses, across a number of demographics. The top three groups included 32% Europeans, nearly 25% from the Middle East region, and 21% from the Indian sub-continent.

UAE accounted for 79.25% of the participants, with 8.5% from Qatar and 4% from Saudi Arabia. The remainder of the hoteliers work in Bahrain, Jordan, Kuwait, Lebanon, Oman, Egypt, Libya and Turkey.

When it came to age, 25.5% were between the ages of 26-30, showing the young demographic of respondents in this region. 20.7% were 41-50 years of age, and 19% were 31-35. Only 1.4% were over the age of 60, with only two respondents saying they were under the age of 20.

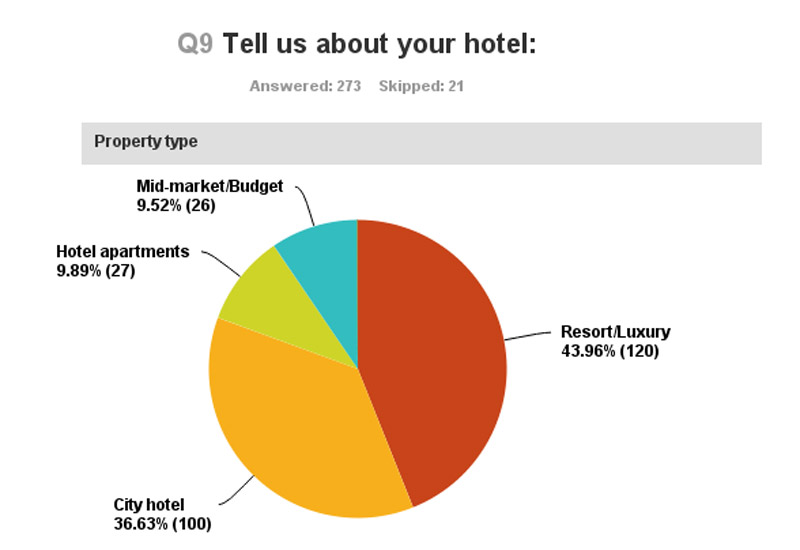

When it came to the type of hotels people were responding from, 43.96% were from luxury/resort hotels, 36.63% came from city hotels, while the remainder was made up of hotel apartments and mid-market properties.

Search our database of more than 2,700 industry companies

Search our database of more than 2,700 industry companies