WHAT’S AFFECTING PERFORMANCE?

Increased competition essentially means increased supply. STR area director Middle East Philip Wooller recently presented the latest Middle East hotel pipeline and performance data to the AHIC Advisory Board which took place in October, where owners and operators alike aired their concerns about the continuing imbalance between supply and demand and the inevitable consequence of declining RevPAR. According to the data, currently, the Middle East is one of only two regions globally (the other being South America) in which supply is outstripping demand, with supply increasing at a rate of 4.9% versus demand at 3.2%.

According to the survey results, 79.49% GMs think there is too much supply for current levels of demand, while 2.56% think the supply isn’t enough. Southern Sun general manager Pierre Delfau tells Hotelier: “We are certainly seeing a decline in demand, however we are still achieving strong occupancy levels compared to other major cities around the globe. New volume leisure segments are coming to our shores and using mid-market properties which should help forming a base business and close the gap between supply and demand. The key issue remains the price point we have set our hotels at, especially in Abu Dhabi, where aggressive rates are offered throughout the year now and occupancies are still at a good level. We are undervaluing the market and this could have a long-term effect, which will impact on profitability.”

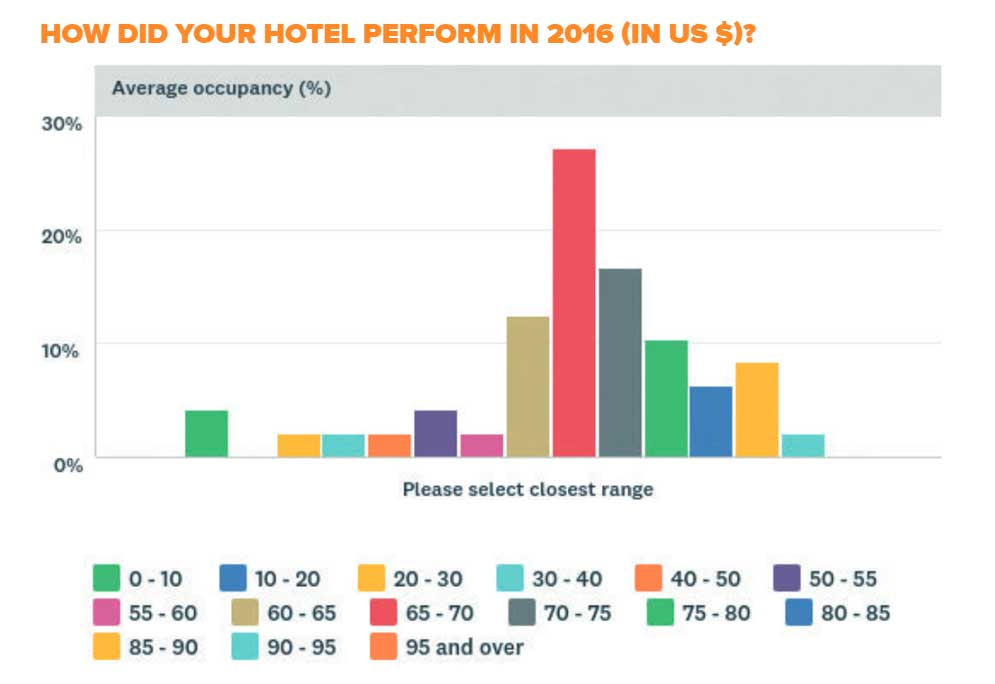

Fraser Hospitality’s Warsono added: “No doubt, the pressure on rates and revenue comes as further new four- to five-star hotels were added to the market in the 2017 — and a lot of hotels refurbishing existing rooms released them back into the market this year. Despite the recent push toward mid-scale hotels, the supply remains primarily focused on four- and five-star, and occupancy has been a healthy 75% since the beginning of 2017. The decrease in the Dubai hospitality performance is perceived as an adjustment of the market rather than indication of distress/oversupply. The outlook of Dubai will remain positive, especially the city continues to invest heavily in tourism infrastructure and diversify towards new source markets such as China, South East Asia, and North Asia.”

Hamdani commented: “In Ajman, we believe that the additional supply of rooms will meet the growing demands in the emirate. ATDD is very active in sourcing new markets — we have recently participated in their road shows in Scandinavian and CIS regions — to ensure that the new rooms will be filled and there is a healthy occupancy and revenue for the hotels.”

The participating general managers in the survey were also asked to pick their top three source markets. Among our respondents, the GCC is leading the pack with 87.23%, Europe is next with 69%, while the Indian sub-continent accounts for 36.17% of these GMs’ source market.

Hamdani continued: “In terms of the overall scenario in the UAE, yes, there is currently an oversupply of rooms, which affect the rates and RevPAR of the hotels. However, we are positive that the supply and demand graph will eventually balance out closer to 2020, and the entire country — not just Dubai — will reap the benefits of the increase in guest arrivals.”

Guminski added that this is only normal for a booming destination. He said: “Is it not the same case for any country coming up on the map as a popular destination? Until last year, the hospitality industry in Dubai had an amazing time. High level of occupancies and rates that today sound like science fiction. Whoever looked at the course of events surely could predict it will not continue forever. The authorities are doing great job in driving demand, and despite the additional supply, occupancy seems to be stable (at the cost of the rates) and this is something that should continue for next few years to come, according to the STR outlook. Buckle up and get through it.”

Stephan Vanden Auweele, area general manager of Sheraton Dubai Creek Hotel & Towers, is also upbeat. He commented: “With occupancies in Dubai hotels averaging at +75%, it is debatable whether the city faces an oversupply of rooms or not. When comparing rooms on a global level however, Dubai is ranked among the highest, and this gradual increase of room inventory can be justified as a build-up to Expo 2020 where the city aims to welcome 25 million visitors.”

From the Northern Emirates, Souab speaks optimistically: “For our destination, the situation is different. We exist in a destination that is still developing and has much potential particularly in the ever growing tourism sector in Fujairah, as the emirate marches towards its 2040 vision development plan of integrated growth.”

| Advertisement |

Search our database of more than 2,700 industry companies

Search our database of more than 2,700 industry companies