RATES, REVPAR, AND OPPORTUNITY

Increased supply can affect occupancy. When asked what occupancy levels were like in 2017 compared to the previous year, 32% said they were slightly lower than 2016, 15% said significantly lower than 2016, while hearteningly, 23% said it was the same as in 2016. A GM commented that his biggest challenge is “retaining occupancy and increasing ADR”.

On the topic of room rates, these have dropped; 43% said that room rates this year have been slightly lower than in 2016, while 23% said they have been significantly lower. A GM said that a concern was “achieving the ADR that my head office and owner expect”, while another said it was “to increase the average rate based on market supply surpassing the demand”.

Auweele commented: “Dubai is a dynamic market that reacts very quickly to ever-changing business demands. Considering that most of our costs are fixed, hoteliers have a tendency to flex rates to drive volume, and balance the situation.”

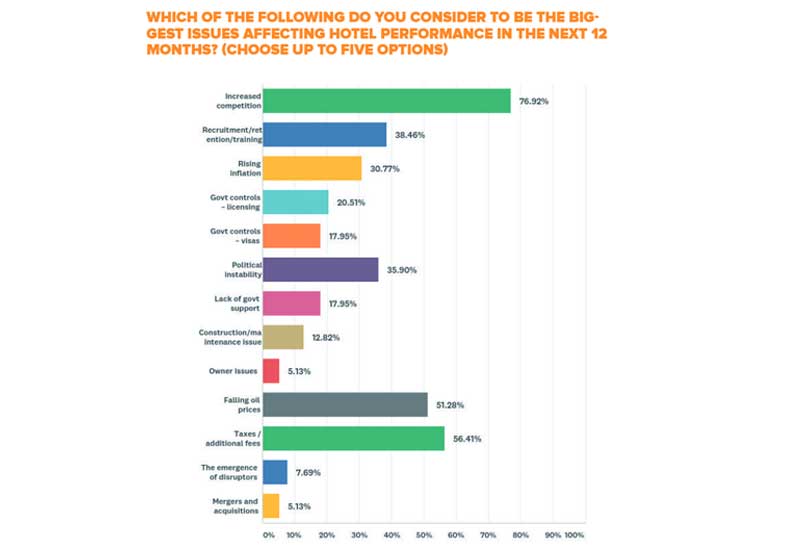

Many GMs in this survey, and at length during the Great GM Debate [pgs 30-37], discussed rate drops and the rate wars. Respondents said “room rates and rate war” and “increased competition and price war” were challenges up in the months ahead. Some suggested alternatives; one said that “rate war control” by the government was desirable, while another suggested that the authorities “put lower-end rate capping as per hotel classification to ensure all segments get their fair share of business”.

Yet there are developments giving hoteliers a reason to hope. Many mentioned the enhancement of visa-on-arrival lists as being positive for their numbers, and some called for further diversification. Others mentioned the Expo 2020 as well as the opening of the Louvre Abu Dhabi as developments to capitalise on. We will wait and see how hoteliers react.

| Advertisement |