General managers in the Middle East have many opportunities to look forward to, and a lot of challenges as well. In October 2016, planning for the 2017 Arabian Hotel Investment Conference (AHIC) started with the annual meeting of the AHIC Advisory Board. In a poll during the advisory meeting, members described business this year as “challenging” and “difficult” with their outlook for 2017 continuing to be “challenging”.

This sentiment was amplified by the latest figures from STR Global, presented by Philip Wooller, which showed a decline in a number of key performance indicators for the industry, including a 9.6% decrease in RevPAR across the Middle East, year to date.

Demand, however, continues to be positive with a growth of 2%, but with new supply up by 4.7%, further pressure on occupancies and room rates is likely in the short- to medium-term. The Middle East is still the fastest-growing region for new hotel rooms as a percentage of existing supply worldwide. In addition, Dubai was the second market globally in terms of GOPPAR in 2015, just behind Tokyo.

What does this mean for the region’s general managers, grappling with issues around new source markets, increased competition, and recruitment concerns?

WHAT’S AFFECTING PERFORMANCE?

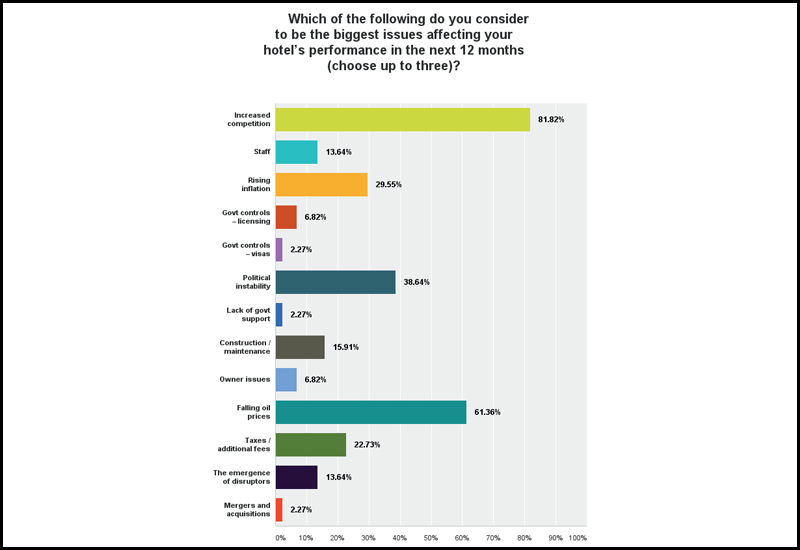

When asked which developments GMs consider to be their biggest issues affecting performance in the next 12 months, 81.82% said increased competition, and 61.36% said falling oil prices, with 80% saying occupancy and revenue was negatively impacted by the oil price drop. However, 11.4% said there was no impact on occupancy and revenue from oil price changes. Nearly 73% of the surveyed GMs said there is too much supply for the current demand.

The Radisson Blu Dubai Media City general manager David Allan told Hotelier: “I very much agree with the sentiment. To tackle these issues we simply keep doing what we’re doing: offering personality-led service and always something a little different.”

Mövenpick Hotel Al Khobar GM Peter Hoesli expanded further: “In my opinion, one issue has led to the other. The falling oil prices have affected many businesses in our destination and led to an increased competition amongst five-star hotels. Whilst only one five-star hotel has recently opened here in Al Khobar, the newer four-star hotels are definitely challenging the business of the established five-star properties.

“As most corporate companies here in KSA’s eastern province are related to oil and gas, their business has clearly lowered due to the falling oil prices and subsequently, companies are reducing the cost of travel and accommodation, amongst others. These all have led to a reduction in the ‘transient business contracted’ segment, but on the other hand, increased the non-contracted segment. Hence, the transient business no-contracted segment has drastically performed better than previous years.”

In the survey, one GM shared anonymously that “room rates have to be dropped to match the market”, while another said that occupancy was not affected, rather, it was rates and revenue.

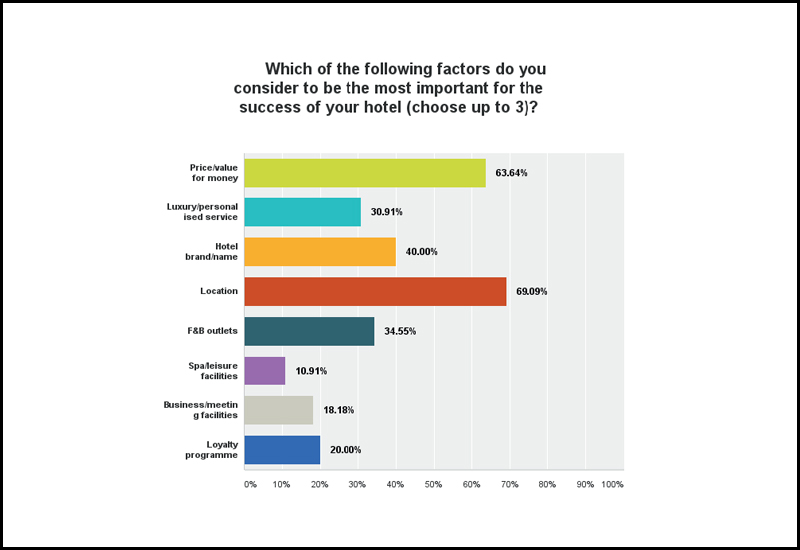

When it came to what the general managers thought were the most important factors contributing to the success of their hotel, 69.09% said location, 63.64% said price and value for money, while 40% said it was the hotel/brand name. This has stayed similar to last year’s viewpoint, showing that general managers believe the age-old chant of ‘location, location, location’ plays an important role in getting guests to book with the property.

DIRECT BOOKINGS

Considering bookings, Hoesli continued with the trends of the times: “We have noticed a good increase in the local leisure segment. Whilst in the previous years the hotels developed relationships with executives in charge of hotel bookings at corporate companies, we now are courting a much broader number of decision-making customers, who are booking within the non-contracted segments, mostly online through the hotel’s website or online travel agents (OTAs). This has heightened online competition amongst hotels in the destination.”

| Advertisement |

Search our database of more than 2,700 industry companies

Search our database of more than 2,700 industry companies