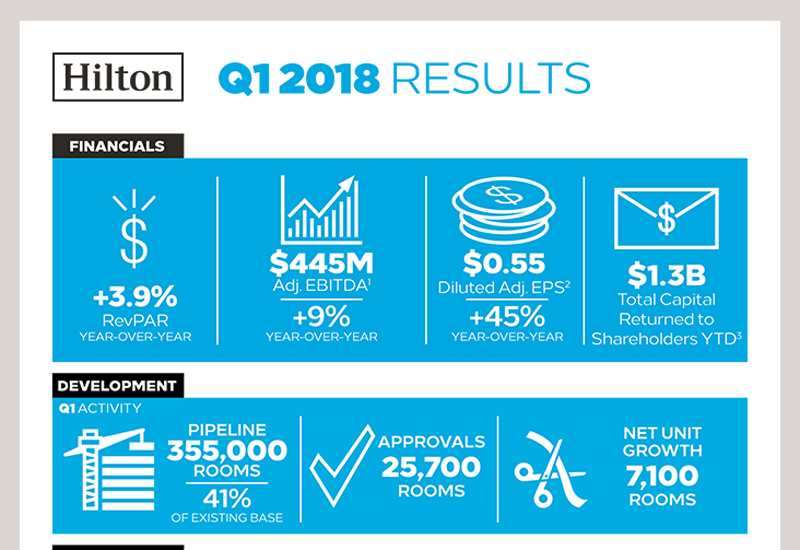

Hilton Worldwide Holdings Inc. has reported its first quarter 2018 results. It's net income for the first quarter was US $163 million and its earnings before interest, taxes, depreciation and amortisation was $445 million, an increase of 9% from the same period in 2017.

Christopher J. Nassetta, president and CEO of Hilton, said, "We are thrilled with the strong start to the year, reporting first quarter results that exceeded the high end of our guidance for system-wide RevPAR, Adjusted EBITDA and diluted EPS, adjusted for special items. As a result of our strong performance and positive outlook for the remainder of the year, we are raising guidance for the full year. We also continue to deliver on our capital return strategy through share repurchases and dividends, returning more than $1.3 billion so far this year."

For the three months ended March 31, 2018, system-wide comparable RevPAR grew 3.9%, driven by increases in both ADR and occupancy. Management and franchise fee revenues increased 12% as a result of RevPAR growth of 3.8% at comparable managed and franchised hotels, license fees and the addition of new properties to Hilton's portfolio.

| Advertisement |

The company also approved 25,700 new rooms for development during the first quarter, growing Hilton's development pipeline to 355,000 rooms, representing 9 % growth from March 31, 2017.

According to Hilton's statement, as of March 31, 2018, Hilton had $6.7 billion of long-term debt outstanding, excluding deferred financing costs and discount, with a weighted average interest rate of 4.25%.

You can read the full Q1 2018 results here.